The Statistics of Selling Online In India

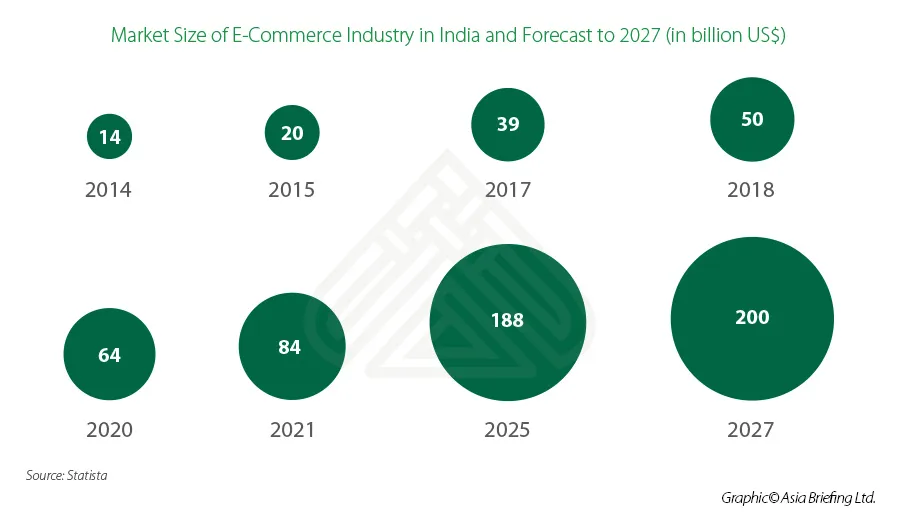

Led by e-commerce giants like Amazon India, Flipkart, Myntra etc., the Indian e-commerce market is riding high on the wave of Indian consumerism, that has picked up pace since 2005 due to favorable market conditions and policy support. India’s e-commerce market size was approximately US$50 billion in 2018 and is projected to reach US$200 billion by 2027.

Although the e-commerce industry experienced a temporary setback due to the pandemic (except for specific segments pertaining to daily consumption needs), the loss of momentum has quickly reversed its tracks. Post the COVID-19 related lockdowns and periodic night curfews, the online retail sector has witnessed an upsurge in the number of several first-time shoppers as well as increasing consumption by those familiar with online shopping. Many consumers, particularly in urban areas, appear to still be wary of frequently shopping in offline marketplaces due to heightened risk of infection.

However, a recent report by BCG-RAI report titled “Racing towards the next wave of Retail in India” expects a consumption led recovery for Indian economy, projecting its retail industry valuation at US$2 trillion by 2032. Within the retail industry, the e-commerce market is poised reach US$130 billion by 2026, as compared to US$45 billion in 2021. The report suggests that industry segments like food and grocery, restaurants and Quick service restaurant (QSR), consumer durables have already re-bounced post the Covid-19 disruption, other segments like jewellery and accessory, apparel, and footwear are also are driving this expansion in the consumption patters.

The upsurge of the post-COVID e-commerce industry is also confirmed by “The 2021 Global Payments Report” by the fintech firm Worldpay FIS. The report forecasts 84 percent growth for the global e-commerce sector, which could reach US$111 billion by 2024, propelled by mobile shopping.

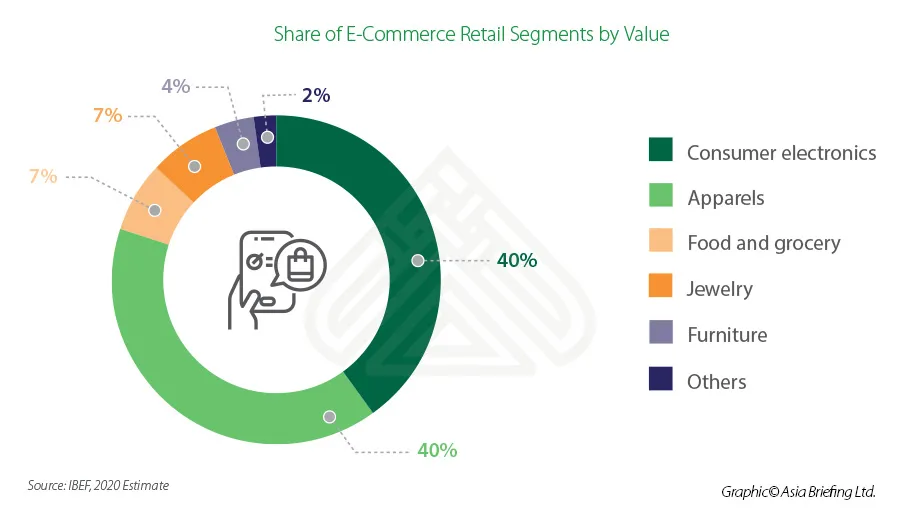

Data reveals that in the e-commerce retail market – consumer electronics, and apparels grab the majority share, with 40 percent each. The apparel fashion market is growing at a CAGR of 11 percent, within which the online fashion segment is growing the fastest at a CAGR of 32 percent. In the online apparels segment, e-marketplace platforms like Myntra, Jabong, Ajio, and Limeroad are leading the race by making fashion more affordable to the masses. Over the last year, major apparel and cosmetic giants like H&M, Uniqlo, Zara, Marks & Spencer, and MAC have also worked on increasing their online presence in India. H&M and MAC have adopted the dual strategy of selling on existing platforms like Myntra and Nykaa to boost short term sales as well launching their own e-commerce websites keeping long-term profitability and branding in mind.

The lockdown has also ushered in changes and broadened the perceptions of kirana store owners (family-owned / mom-and-pop shops) across the country, who were previously skeptical of integrating with the e-commerce sector. The 12 million-strong network of kirana shop owners capture the lion’s share of India’s retail market and their integration with e-commerce platforms will ensure seamless delivery of merchandise along the length and breadth of the country. Flipkart has partnered with 27,000 kirana stores across 700 cities, while Amazon has partnered with 20,000 kirana stores. Reliance’s JioMart has also come forward to provide digital terminals to offline shopkeepers, for inventory management and stock ordering from Reliance’s network of wholesalers.